Whether it is in the form of a large personal loan you took out to help pay for something that just couldn’t wait until you saved up, student loans that helped you graduate on time, or even just a single credit card you use to get gas and hotel rewards, debt is a way of life for many of us. While having debt hanging over your head can be extremely stressful, however, it does not have to push you over the edge. All it takes is a little bit of planning and knowing your payoff amount to better manage your finances.

Know the State of What You Owe

Our experts at Liberty Debt Relief recommend that you calculate your payoff amounts on every outstanding form of debt that you have every few months. If you look at your credit card or loan information online, you will often see a section that shows how much your balance is, but that number does not take your interest, credit terms and conditions, or any fees into consideration. Unlike simply looking at your monthly payment or the overall outstanding balance, knowing how to calculate your payoff amount will ensure that you’ve accounted for all of the fees

To calculate, all you need to know is the total amount you owe, the interest rate, the amount of time it will take you to get out of this particular debt, and if there are any fees associated with paying off your debt early or anything similar. Luckily, there are plenty of online calculators available to run the specific numbers for you.

Now, for example, let’s say you want to pay off your $1,000 debt over the next 12 months and this particular account only has a five percent interest rate. That means that, assuming your balance were to stay at $1,000 every month, you would be accumulating $50 in interest each month as well. However, because you are working to pay the debt off, your interest charges every month will go down as long as your amount owed goes down. So, to pay off this $1,000 debt in 12 months, you would need to make payments of $86 every month. You could choose to put more towards this debt to pay it off quicker. If you were to pay about $100 a month instead, for example, you could likely pay off the debt in only 10 months.

Lowering Your Debt

Lowering your payoff amount can be difficult depending on your situation. The first thing all debt settlement services ask new clients is if they can make higher payments. As seen in the example, higher monthly payments mean less outstanding balance and less damage your interest rate can cause. There are a few other methods for lowering that amount, as well.

You could try speaking to your lender about your situation. If you have been a good borrower and have always been on time with your payments and made them in full, then they might be willing to work with you a bit. Every so often you can convince your lender to lower the interest rate on your account so you accrue less debt every month, which can make a significant impact. If the previous example had a 15 percent interest rate instead of 5 percent, for instance, that is an interest charge of $100 more on your account every month. That can bring about more than $1,000 interest a year if you are not careful.

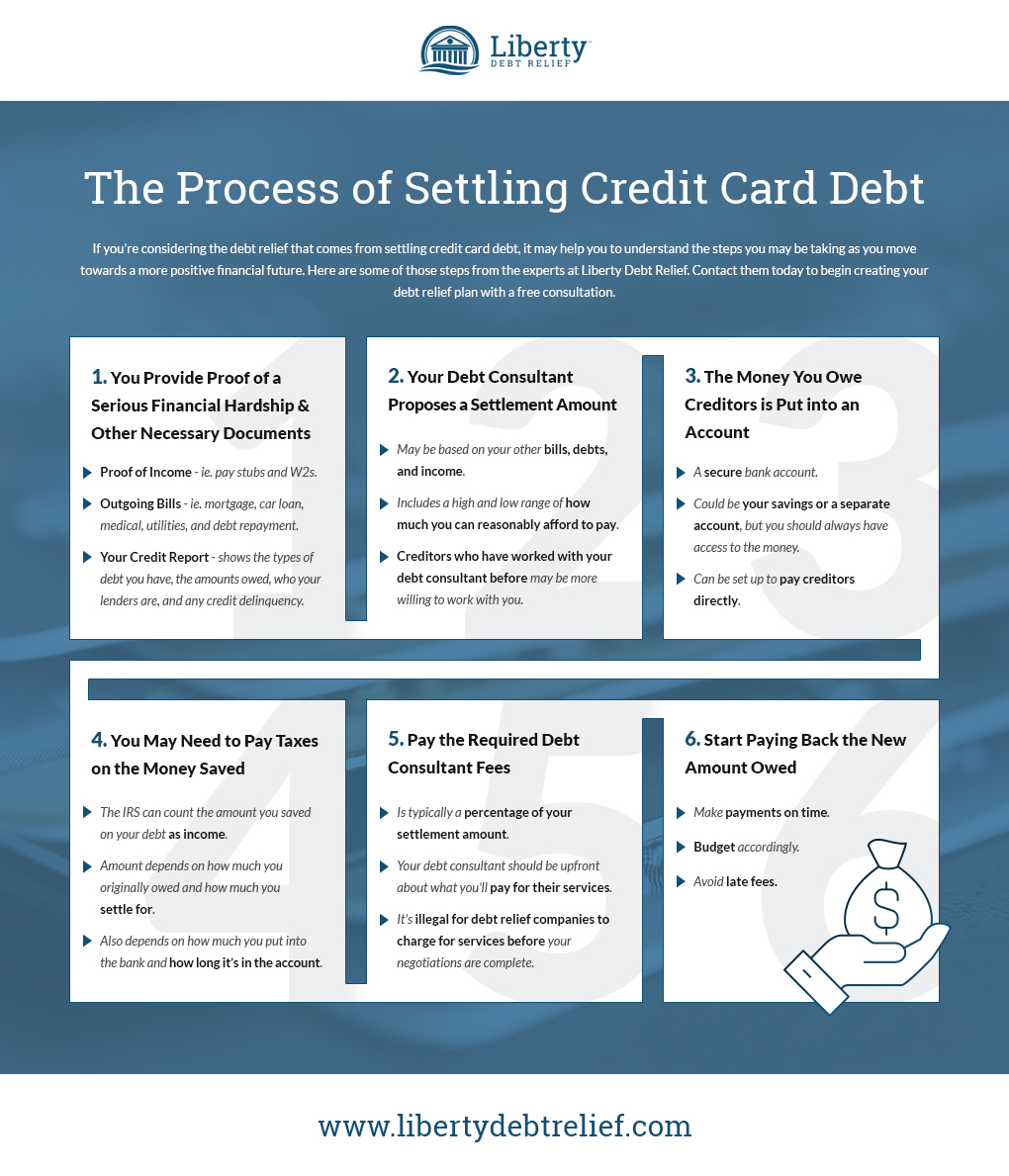

Debt Settlement Consultants Will Negotiate Lower Terms

Of course, for many people, their payments are already too high for their circumstances and what they really need is another solution altogether. With a debt settlement program, a debt relief consultant will teach you how to calculate your payoff amount with terms that actually work for you. Instead of simply changing the life of the loan or increasing your payments, they will work with you and your lenders to try and establish a new outstanding balance that is lower than the current amount and possibly even reduce the interest rate.

By having a more manageable payoff and a lower interest rate, your timeline to get out of debt will be cut dramatically, and even if your payment amounts stay the time, they will have a much higher impact. The best part is that your debt consultant will handle all of the negotiating for you — all you have to do is tell them what you can and can’t afford and they will essentially take care of the rest.

Seek Assistance from the Debt Relief Experts

If you are struggling to deal with your debt payoff amount, you do not have to tackle the problem alone. Liberty Debt Relief’s specialists have years of experience and invaluable knowledge to make sure you can not only pay off your debt but stay out of debt in the future. Whether you want to know how to calculate payoff amounts on your own, want to enroll in a debt settlement plan, or want any other kind of financial information, our team is here and happy to help. Make sure to call us today for a free consultation. We can’t wait to help you get on the road towards financial freedom!