How Should I Budget Once I Get Debt Consolidation

Life After Credit Card Debt Relief

Getting out of debt is a process, but the moment you get approved for debt consolidation is the moment you take your first step toward a better financial future. As wonderful as this is for getting credit card debt relief, it is crucial to balance out your new plan with a budget. Doing so will make sure that you not only pay off your debts in a timely manner but will also ensure that you do not end up back in the same situation. Liberty Debt Relief is here to help you discover how to stick to a budget in a way that is easy to follow and that teaches important money management skills.

Choose Your Budgeting Method

Before you can begin planning your new budget, you need to figure out a system that will help you stay on track. After all, if you know you won’t follow your system, there is no way you will stay accountable. There are plenty of options to choose from to get this first step done, such as using an online program or creating a spreadsheet.

If you are looking to work with a credit counseling company, your financial advisor can help you determine what works best for you, or you can simply try out a few different methods to see what fits your lifestyle best. People who are new to budgeting and really are not too sure how they are going to stick to a budget may be better suited for a software program that will walk you through the steps and provide electronic reminders. Others, like experienced budgeters or even those who simply retain information better from writing it out, may do better with the pen and paper method.

Know Your Goals

No plan can be well developed without an objective in mind. With debt consolidation loans and credit cards, one of your primary goals should be to make your monthly payments in full and on time so you can be well on your way to debt relief. Other common objectives people have are to put more money into their savings account, invest more in the stock market, or even improve their credit score.

There are also short-term goals, such as getting ahead on your utility bills, getting a new laptop for graduate school, or maybe even planning a vacation. Once you know your long- and short-term goals, write them down, along with how much money is needed for each item and the time frame you have to collect the funds.

Understand Your Cash Flow

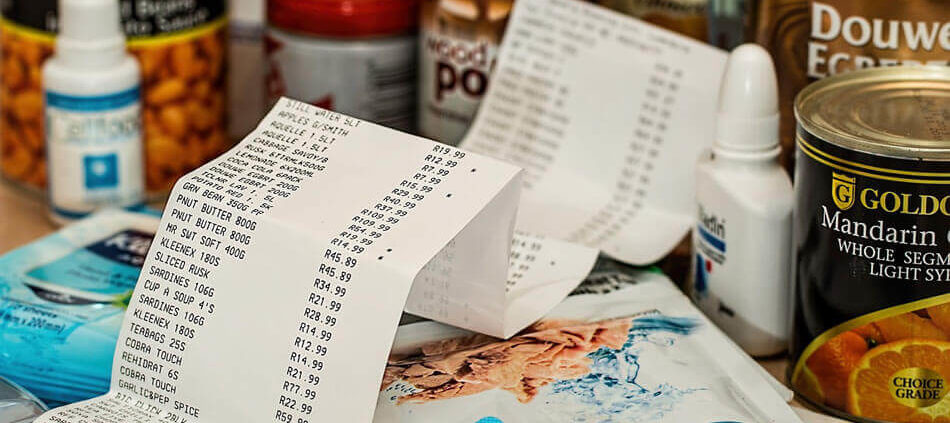

Now that you know what you want, you need to know what you have to get started. Take a look at your regular income and expenses, as well as any extra income or expenses you may encounter throughout your debt consolidation plan. Your income list should include your regular wages and/or salary, part-time work, and any bonuses you can expect, while your expense list should include your utility bills, rent, mortgage, food, gas, and, of course, your debt consolidation loan payment.

Pulling up your bank statements, credit card and loan statements, utility bills and pay stubs can help ensure that you get on the right track for debt relief at the start. All of these records are available for free, and, if you work with a debt relief counselor, bringing these documents to your meeting will ensure you get accurate information.

Determine the Essentials

The best way to effectively learn how to stick to a budget is by understanding what items in your life are essential. While your consolidation payment, utility bills, groceries, and gas are definitely crucial while you pay off your debts, more leisurely items are not. Many people find that they spend a lot more on these non-essential activities every month than they thought. Getting your nails done every few weeks, going to the movie theater regularly, eating out at restaurants, shopping sprees, and even choosing to grocery shop at artisanal stores rather than larger grocery chains can quickly add up.

While you are in the process of relieving debt, you will need to cut back. You do not have to necessarily cut them out completely, but limiting them will allow you to put more money towards paying off debts in a shorter amount of time. For instance, if you usually eat at a restaurant twice a week where you spend $30 each time, you can choose to only go to a restaurant twice a month. This simple change would save you $180 a month and you can allocate those funds toward your loan payment.

Keep Yourself Accountable

The most crucial aspect of seeking out credit card debt relief is keeping yourself accountable. In the end, your budget will not be helpful if you don’t stick to it. Working with a debt management counselor is a great way to accomplish this, as they can offer valuable tips and resources to make sure you stay on track every month.

Keeping yourself accountable also means rewarding yourself. Even though your budget may be tight, make sure to factor in treating yourself every so often. This could be through budgeting a night out every month or maybe even a vacation eight months after you start your debt consolidation plan. However you choose to do so, just make sure that you factor these rewards with income funds, not with credit card funds, so you don’t get yourself in more debt.

Where There’s a Will, There’s a Way

Budgeting is an important step in getting out of credit card debt and getting the financial relief you deserve. Liberty Debt Relief can provide you with more advice on these topics, as well as debt settlement services that could significantly help your financial situation. Contact us today to get started working toward your goals.

Leave a Reply

Want to join the discussion?Feel free to contribute!