What Do the Best Debt Relief Companies Offer?

Who Needs Help From the Best Debt Relief Companies?

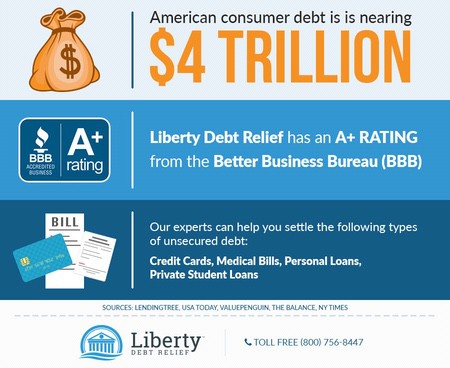

If you are currently encumbered with an overwhelming amount of debt, you are not alone. According to Time Magazine, Americans younger than 35 (meaning Millennials at the current time) are, on average, over $67,000 in debt, while those ages 45 to 54 have an average of nearly $145,000 in debt.

Certainly, people of all ages, from all walks of life, are facing large sums of debt, and Liberty Debt Relief knows exactly how to help.

The Danger of Finding the Wrong Company

Climbing out of a financial hole is a monumental task, which is why many people opt to receive help from debt relief services. Before making any commitments, though, it is important to know how to choose a debt consolidation company that is sensible for you.

It would be nice if every debt relief company provided the services they advertise. Alas, in reality, a lot of these businesses can make your financial troubles even worse, and the difference between the best debt relief companies and the others is significant.

It is common for untrustworthy services to make promises they cannot keep, to charge big fees before providing any assistance, and to erode your relationship with creditors beyond repair, which, among other problems, can result in lawsuits against you.

In other words: Those who want professional help with debt relief need to do a lot of research.

So if you are seeking the counsel of financial experts, here are seven things to look for:

They are Properly Accredited

Of course, you want to work with a business that has a strong reputation. The ones that are not accredited are far more likely to be scams or generally ineffective. The best debt relief companies have impressive accreditations, including a Better Business Bureau (BBB) rating.

Liberty Debt relief has an A+ BBB rating, as well as accreditation from the American Fair Credit Council! (AFCC)!

They Have Good Reviews Online

When friends decide to go to the movie theater, they will probably take critics’ reviews into account before making a decision on which film to see. When a couple is planning a date, there’s a good chance they will consult Yelp to make sure they pick a good spot. And if someone needs work done around the house—landscaping, plumbing, cleaning—there is a plethora of websites that list users reviews.

If we take the time to examine these matters before pulling out our wallets, we should do the same when browsing for the best debt relief companies. Doing so does not require a big time commitment and can make a big difference in your future.

Indeed, when you are figuring out how to choose a debt consolidation company, it is vital to consider the experiences others have had with that business.

They Are Compassionate

People trying to get out of debt are in vulnerable positions. They have good reason to feel uneasy, and those tasked with relieving their burdens need to show they care. Without question, the best debt relief companies are staffed with genuine, kind-hearted employees who make the wellbeing of their clients their top priority.

As you begin to speak with financial experts, take note of the way they conduct themselves. Are they paying close attention as you describe the details of your predicament? Do they ask a lot of useful questions? Do they go out of their way to make you feel comfortable? Do they refrain from judging you for the decisions that led to your debt?

Remember: The debt relief expert you select will help you make some of the most important choices of your life. You want to ensure that person is committed to fostering a meaningful relationship with you.

They are Easy to Get in Touch With

If you are nervous about your financial situation and have an important question to ask, you do not want to sit around for a long period of time waiting for a response. The best debt relief companies are highly responsive to your inquiries and will go above and beyond to supply the answers you need.

To contact Liberty Debt Relief, call (800) 756-8447 toll free, or email us at SUPPORT@LIBERTYDEBTRELIEF.COM. Of course, completing our application form offers you a chance to detail your situation so we can get started with you right away, if you qualify.

They Don’t Make Claims That Seem Too Good to Be True

If you are stuck in a deep pile of debt, it can be exciting to hear a financial expert say they are able to quickly and easily fix all of your problems. Unfortunately, that is seldom possible. Truth is, working your way out of debt requires a lot of sacrifices, discipline, and tough decisions.

The best debt relief companies won’t tell you they can wave a magic wand and make your worries disappear. Instead, they will be honest with you and suggest a practical approach.

They Charge Reasonable Fees

As you are learning how to choose a debt consolidation company, you should write down what each business charges for its services. The one you want to choose will charge reasonable fees that will not worsen your financial issues. More importantly, they will not charge you any upfront fees before providing you services.

No upfront fees

Keep in mind, Liberty Debt Relief only charges once your debt has been settled with your creditors, never before. That is because we follow all Federal Trade Commission guidelines regarding your protection against such fees before receiving services. In addition to our ethical practices, which earned us our BBB and AFCC accreditations, our fees are very competitive within the industry.

They Offer Free Consultation

The best debt relief companies will not make you pay before demonstrating what they know and how they can assist you. At Liberty Debt Relief, we can take an in-depth look at your unique situation free of charge. In the process, we will clear up any confusion you may have regarding debt relief, debt consolidation, and debt settlement, and illustrate how we can help.

Click here to get in touch with one of our experts and learn more about how we can help you today.

Leave a Reply

Want to join the discussion?Feel free to contribute!