Getting a Handle on Debt Relief Strategies

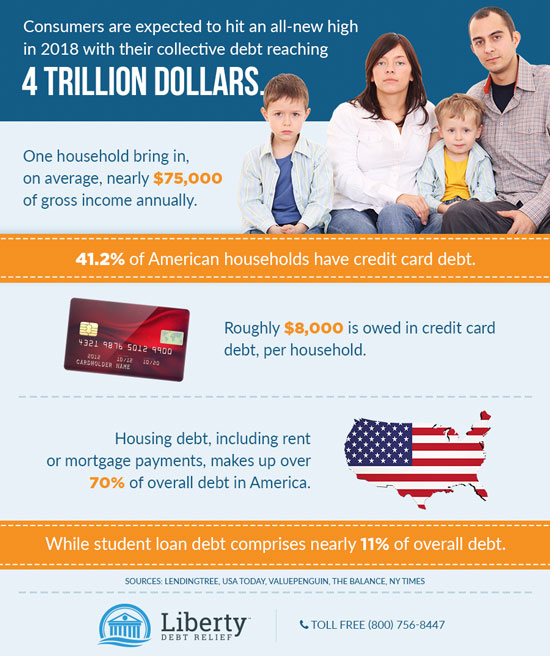

Debt is, without question, one of the biggest issues facing people in the United States today. According to the Federal Reserve Bank of New York, America’s overall debt reached a record $13 trillion in 2017—up from $280 billion in 2018.

As a result, knowing how to prioritize debt repayment is an essential skill. Indeed, effective debt relief strategies can build financial security, increase your future earnings, and give you the peace of mind you deserve.

Unfortunately, there is no one right way to climb out of debt. Every person’s situation is unique; as such, each case needs to be handled in a specific way.

Many financial advisors tout the effectiveness of paying off big debts first, but many others say it is best to tackle small bills before the rest. Which approach is right for you? Here are six questions you should answer as you form your plan:

How Organized Am I?

First, those learning how to prioritize debt repayment need to get organized. Proper debt relief plans cannot be made if you don’t have a firm grasp of your overall finances. So if you have not done so already, you should make a spreadsheet listing out each debt, the type of debt, the interest rate, the term, and the credit limit, if it applies. That way, you can gain a strong sense of what you are up against.

What Kind of Debt Do I Owe?

Everyone building debt relief strategies needs to understand that not all debt is inherently bad. Believe it or not, there is a such thing as “good debt.” In essence, a financial obligation is considered good debt if can help you make money and boost your net worth.

Student debt is one example. According to the New York Times, student loan debt makes up over 11 percent of the total debt in America. While paying off school loans can be an arduous task, receiving quality education can have a substantial, long-term effect on the quality of your life. When schooling is effective, it opens you up to new jobs and, by qualifying you for higher salaries, can give you a high return on investment. Real estate, business ownership, and investments can be considered good debt, as well.

Conversely, bad debt is any form of debt that does not have the ability to enhance your life. Credit card debt fits the bill, and, 41.2% of American households have this type of debt. This liability is created when one spends too much money with credit cards and cannot make their monthly payments. As time wears on, interest rates and late fees make the debt more expensive. When someone uses a credit card to buy a giant television and is unable to pay the necessary installments on time, that person has accrued bad debt.

Conventional wisdom states that you should pay off your bad debt first. This is the case for a number of reasons.

First of all, bad debt from credit cards, unsecured loans, and car title loans tend to have high interest rates. Additionally, many forms of good debt, like student loans and mortgages, have lower interest rates and are tax deductible. If you make regular payments on your good debt, and go out of your way to eliminate your bad debt, odds are you will be off to a good start.

Which Debts Have the Highest Interest Rate?

While it often makes sense to eliminate bad debt first, not all debt relief strategies can be so black and white. Many people wind up with awful student loans that have high interest rates and short repayment terms. Conversely, there are lots of decent automobile loans to be had.

Once you have made your spreadsheet, you should determine which obligations have the highest interest rates. These, by definition, will become more expensive to pay off over time. So it makes sense to get rid of them as fast as possible.

Also known as the “avalanche” method, targeting high interest rates first will save you money in the long run. Many people efficiently get out of debt by paying as much as possible toward their loan with the highest interest rate and making the minimum payments to the rest of their bills every month. Once they have finished paying for the loan with the highest interest rate, they move onto the second-highest, then the third-highest, etc.

Some avoid this approach because it does not provide constant rewards. This is understandable, as it can be demoralizing to make lots of payments and not see the number of obligations dwindle. It can feel great to knock out the smaller debts in short order, but, ultimately, extinguishing your highest interest rates first will save you money.

What is My Credit Score?

Understanding your credit score is critical any time you are working on debt relief strategies and learning how to prioritize debt repayment. In short, your credit score is a number that sums up your financial life. It is updated every month by three major credit bureaus: Equifax, Experian, and TransUnion. Your score is important because it shows lenders how likely you are to repay your debts.

Generally speaking, here is how the different scores break down, courtesy of Equifax.

- 300 to 579 is considered new or bad credit

- 580-669 is considered fair credit

- 670-749 is considered good credit

- 750 and higher is considered excellent credit

If your score is low, you need to ask yourself the following question…

Do I Plan on Making a Big Purchase in the Near Future?

If the answer is yes, then it is important to raise your credit score quickly.

Low credit scores can make it difficult to buy a house, purchase a car, or get a new line of credit. Moreover, when someone with a low score does receive one of those things, they almost certainly have to pay higher fees and interest rates. This is because they are dubbed “high-risk borrowers.”

One of the best ways to boost your score is to pay off your big credit card debts first. So if you need to get your score up fast, that is a method you should apply to your debt relief strategies.

Should I Consult with Professionals?

At Liberty Debt Relief, we have the experience needed to help you generate a sound plan. We take pride in our ability to take the confusion out of debt relief, debt consolidation, and debt settlement.

Our team of experts can construct debt relief strategies for people of all ages and circumstances. If you want to learn more about how to prioritize debt repayment, contact us soon.