With debt being such an overwhelming subject to deal with, it can be easy to forget that it is a problem that impacts millions of people every year. Whether you are a relatively new borrower at only 18 years old or have maintained a well-seasoned financial history for decades, there is a constant stream of debt potential. There are many types of debt out there and, depending on your age group, you may be more susceptible to certain kinds. Luckily, Liberty Debt Relief has all the information you need to prevent falling for financial traps.

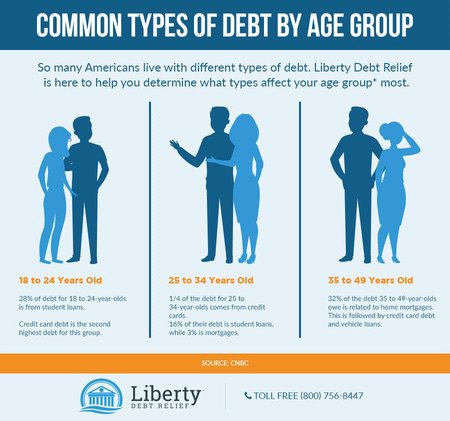

So many Americans live with different types of debt. Liberty Debt Relief is here to help you determine what types affect your age group* most.

- 28% of debt for 18 to 24-year-olds is from student loans.

- Credit card debt is the second highest debt for this group.

- 1/4 of the debt for 25 to 34-year-olds comes from credit cards.

- 16% of their debt is student loans, while 3% is mortgages.

- 32% of the debt 35 to 49-year-olds owe is related to home mortgages.

- This is followed by credit card debt and vehicle loans.

Source: CNBC

Ages 18-24: Student Loans

The cost of attending college only continues to grow. In fact, the cost of college from 1998 to 2019 has increased by more than $20,000, which is why it is no surprise that so many young adults are suffering with student loans. In many cases, students do not leave college without obtaining at least $25,000 in student loan debt, which can take decades to pay back between high interest rates and finding a job that pays enough to make all the loan payments.

While there are various types of consumer debt, this is one of the easiest to get trapped into. Young adults are constantly told to pursue college so they can get a good career, which is definitely a good choice, but for those who have no choice but to rely on student loans, it can also be a financially devastating move. Only six months after graduating, you will have to begin paying back your loans and, by that time, they have already accrued months or even years of interest.

To avoid falling further into debt during college, consider finding a part-time or summer job so you can limit the number of loans you have to take out initially. Of course, you can also seek a debt settlement if you hold private student loans and you are experiencing a serious financial hardship that is keeping you from paying on your accounts.

Ages 25-34: Credit Cards

One of the most common types of debt across the board is credit cards. While everyone seems to have one, 25- to 34-year-olds seem to have the biggest issue in paying back their credit card debt. The average debt in this category across the United States is nearly $6,000 and, when you consider the high interest rates, it is really no surprise that so many people end up in crippling credit card debt.

Another reason people of this age group so easily end up with this debt is because, almost as soon as you get one credit card, essentially every financial company starts sending credit card offers. People in this age group are still pretty new to debt management and many make the mistake of opening up multiple credit cards and spending thousands of dollars on their credit lines every month that they can’t afford.

The best method of defense for this group is to avoid opening up multiple lines of credit. Even if you feel like doing so would be affordable, there is really no way to guarantee that the same income you have this year will be the same you have the next and there is a good chance you will overspend. Secondly, make sure to create a budget that you are confident you can stick to. If you are ever unsure about your financial situation, it is also a good idea to reach out to friends or family who have experienced a similar situation or work with an accredited debt relief company. Finally, if you’re already in over your head, credit card debt settlement may be an option for you.

Age 35-49: Mortgages

Mortgages are a type of consumer debt that often goes forgotten but is very impactful. At this point in one’s life, they often want to go from apartment hopping from year to year to really settling down and purchasing a home and a mortgage is often the answer. For those who are truly suffering from debt, they may have to take out a second mortgage just to be able to afford their day-to-day life.

To avoid going into mortgage debt, the best thing you can do is avoid purchasing a home that you cannot eventually pay off for the most part. While renting an apartment or a home may not be your ideal life, it can save you thousands of dollars of debt in the long run. If you really have no choice but to take out a mortgage, there are also some things you can do to avoid additional costs. Make sure to find out if there are any prepayment penalties, and if not, make as many extra payments toward your principal balance as you can. It is also in your best interest not to extend your repayment plan and to make sure your loan is set at a fixed rate.

Age 50+: A Diverse Mix

While older individuals typically have the lowest amount of overall debts out of all the age groups, they do typically have the most diverse debt portfolio. Because they have had more time to develop a financial history, they typically have a larger mix of credit card, mortgage, loan, and many other types of debt. Another problem in this group is that many do not have a lot of savings available and, therefore, do not have a safety net for the debt as they get closer to retirement.

For this group, it is essential to have as much money saved as possible so expenses and debt won’t ruin your retirement. This could be in the form of a corporate or government-sponsored savings plan, such as a 401(k), or even a general savings plan that you have regularly contributed to over the years. However you choose to do it, make sure to have enough saved up that you can live off of if need be while also diminishing your remaining debts.

Know What to Expect

Knowing the types of debt that generally affect people within your age group, as well as others, allows you to take actions that prevent you from falling into financial traps. Liberty Debt Relief can help you learn what kinds of debts to avoid and limits that you can set to help you falling behind on monthly payments and running through your safety net too early. Contact us today to get started with your debt relief plan.