Reasons so Many American Households are Still Drowning in Debt

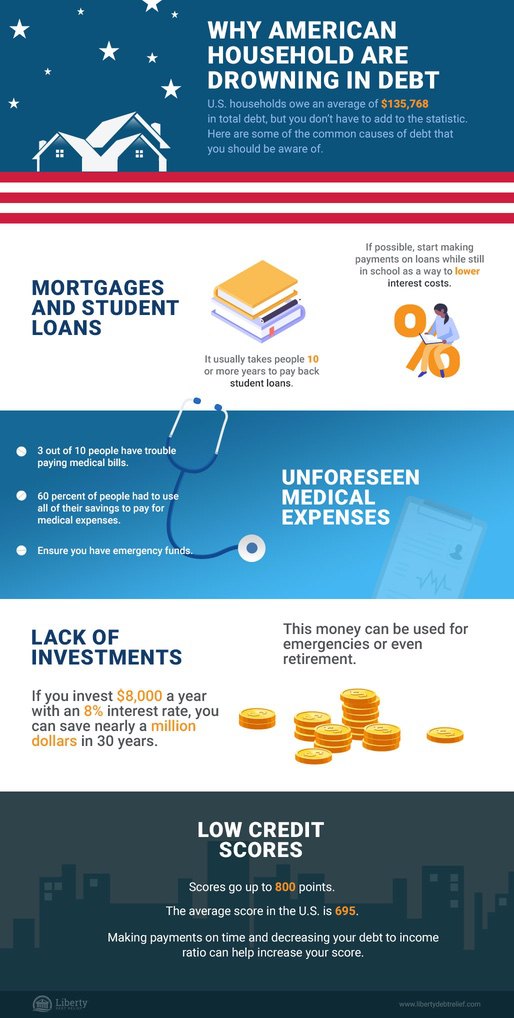

Getting out of debt is not easy by any means. In fact, there are millions of people throughout the world who are constantly struggling to find their way out of debt. American households owe more than $135,000 in debt from credit cards, mortgages, auto loans, student loans, and more. It is a high number that can seem intimidating, but the good news is that there are clear reasons why so many people are struggling. If you are wanting to turn your financial life around and start paving the way to a debt-free future, then take a look at why so many American households are still drowning in debt and steer clear of the common problems.

Student Loans

As valuable as pursuing higher education is, it also comes with a burdensome and heavy price tag, especially if you don’t minimize credit card debt and loans in college. On average, U.S. households owe roughly $47,000 in student loans alone. Getting a bachelor’s, master’s, or doctoral degree can cost hundreds of thousands of dollars per year, and for many careers, these degrees are non-negotiable. It is nearly impossible for full-time students to pursue these degrees while also working a full-time job that pays enough to forego these loans, and so many people will defer their payments until after graduation. But by that time, loans will usually have already accrued a few hundred dollars or even thousands of dollars in interest and will be that much more difficult to pay off.

Between trying to find a job, affording a place to live, and paying off thousands of dollars of student debt, many American households take a decade or more trying to pay back student loans, which can wreak havoc on their credit score and general financial status in the process.

No Savings

Saving money can be extremely difficult, especially when you can’t even afford to pay bills or other outstanding debts. Unfortunately, not having savings is also a primary reason why so many people end up past the point of no return in regards to their debt. What so many people do not realize is that even the most prestigious American debt relief services will make it a point to tell you that allocating money toward savings is essential.

Savings accounts are not just for retirement in 30, 40, or 50+ years; they are a safety net for any unforeseen situation. If you have an unexpected medical emergency, for example, you are putting yourself at risk of going into severe debt trying to pay off your sudden medical bills. Even other life happenings, such as losing your job, getting a flat tire, or finding out you are having a child, can suddenly set you back thousands if you are not prepared. By making an effort to even save $400 a month, you can make sure that any of these occurrences will not make life more difficult.

No High-Return Investments

Similar to savings, many households also fail to make financial investments. Studies have found that many people choose to stay away from investing because they do not understand the process and/or are frightened about the possibility of the stock market crashing. While these are valid concerns, they do not negate the financial benefits of having a high-return investment.

A simple investment of $50 to $100 a month can turn into earnings of $25,000 or more within just a few years. You can do this with stocks that you pick and choose on your own or even through a 401k retirement savings plan through your job. Having this money available is a great way to set up an extra emergency fund and save for your future. If you ever come across a situation where you are really strapped for cash and need help immediately, you can take some money out of your investments so that you can avoid missing payments and going into crippling debt or even going bankrupt.

Low Credit Scores

Unfortunately, all it takes is one poor mistake or a couple of months of bad financial luck for American households to fall into a severe debt that follows them for years. Many people end up in a situation where they missed a couple of bills or lost their job and it caused their credit scores to plummet right before their eyes. Credit scores are fixable, but doing so takes time, patience, and financial stability.

For a lot of people, discovering they have a low credit score happens around the same time they realize they need a loan or are trying to make a large purchase, such as a home or vehicle. With a low credit score, you will likely still be approved for these things, but not without recompense. Lower credit scores mean higher interest rates and higher monthly payments that are much more difficult to pay off. Having that added monthly expense stresses your finances and, many times, you may end up even more behind on payments and farther behind in debt because of the interest costs.

Speak with a Trusted Specialist

Though there has been a spike in American debt, there are plenty of relief services available to make sure you and your family does not become a part of that debt bank. If you take the time to understand what causes thousands of households in the U.S. to rack up such high levels of debt, you can set you and your family up for financial success. Contact Liberty Debt Relief and find out how experienced debt relief specialists can make sure you and your family come out on top.

Leave a Reply

Want to join the discussion?Feel free to contribute!