How Debt Settlement Can Benefit Your Credit

Your Debt Settlement and Credit Score

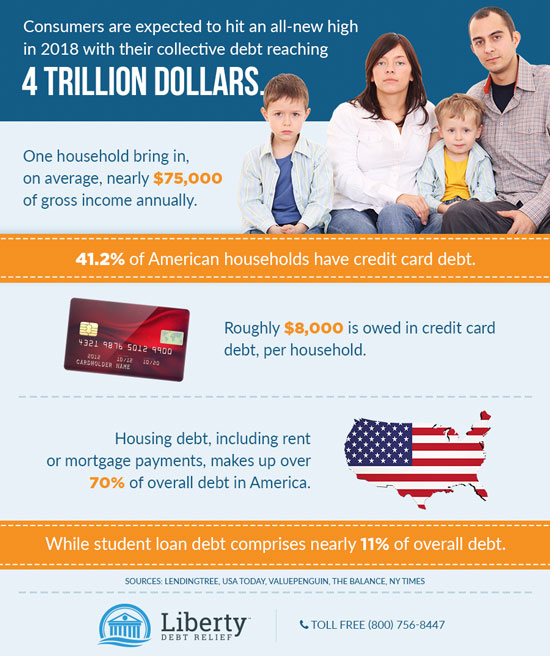

If you’re late on one to three payments or have used 80% of your available credit across your accounts and you’re searching for ways to alleviate debt, you may be considering taking advantage of a debt relief settlement. This will allow you and your debt relief company to negotiate with your lender for a lower amount. Settlement can be the best option available for many people, but, before deciding to go with this route, it is important to understand the relationship between debt settlement and your credit score.

So, just how does debt settlement affect your credit? Debt and credit go hand in hand, so when you open any kind of account that puts you in debt, it will directly reflect on your credit report, which is a way for future lenders to see how well you manage your lines of credit. It’s easy for people to find themselves in a situation where they have accrued a lot of debt, and when that happens, your credit score can take a significant hit. Luckily, a great option available for many people is debt settlement. Along with potentially minimizing the negative toll on your credit report, you can eliminate your financial risks quicker and easier and work on improving your credit score.

Lower the Amount Owed

One of the biggest factors in your credit score is the amount you owe, and Liberty Debt Relief may be able to settle for as low as 45 cents on the dollar! In fact, your debt amount is about 30 percent of your total credit score. If, for example, you are $10,000 in credit card debt and have mostly or completely maxed out all of your credit cards, then this part of your credit score is likely suffering greatly. Part of this 30 percent is determined by your debt to credit ratio, so when more than 80 percent of the funds available on your credit accounts are used and you can’t afford to pay it off immediately, settling the debt may be the best option.

These programs can take between 24 to 48 months, but debt settlement may improve your financial management skills and credit score after you have paid on the negotiated amount for at least six months. More importantly, the better you utilize your credit card accounts, the sooner you can build a strong and secure credit report.

Begin Making Payments on Time

Accounting for 35 percent of your credit score is your ability to make payments in full and on time. Unfortunately, making the minimum payments every few months simply will not help get you completely out of debt. It is important to understand that how often you make payments and in what amounts does impact your debt settlement terms and affect your credit. The good news is that, even if making payments was not always possible in the past, debt settlement services can make them more manageable.

Your debt relief expert will look at your income and expenses and help you create a budget that makes sense for your situation. From that information, together you will determine an amount you can afford to pay within the next few years and then negotiate that amount with your lender. In the end, you will have a significantly lower debt that you can afford to make payments toward every month. Not only will your credit score improve, but it will also make you more motivated to work toward long-term financial stability.

Avoid Bankruptcy and a Negative Financial Future

One of the biggest mistakes people make when they are trying to get out of debt is immediately filing for bankruptcy. While it is sometimes necessary, this method of debt settlement can severely impact your borrowing potential and credit score for at least a decade. Along with lowering your credit score several hundred points, bankruptcy is also listed on all financial paperwork, including for potential jobs, apartments, homes and future credit lines.

Another risk with bankruptcy is losing valuable collateral. Nobody wants to lose their car, home, business, or savings when they already feel as though they are at a financial rock bottom. Debt settlement can help you avoid that scenario by offering a solution that allows you to repay your debts in a way that works for you, not against you. The negotiated plan will allow you to make affordable payments and keep the items you value most. Moreover, when employers or apartment managers see debt settlement on your record, it will just be further proof that you do your best to make your payments and are willing to work with people to come up with a compromise.

A Solution that Suits Your Needs

If you are struggling to make monthly payments and feel backed into a financial corner, consider learning more about debt settlement services, like those at Liberty Debt Relief. This form of debt relief is designed with you in mind, and we want to make your negotiations as successful as possible. Get in touch with our experienced debt relief experts today to get a personalized debt relief solution.