Should I Claim Bankruptcy or Seek Debt Relief?

Weighing the Options: Bankruptcy or Debt Relief

If you’re struggling with huge amounts of debt and don’t know which way to turn, debt relief can be an amazing tool to help you regain control of your life. Especially when medical bills are piling up and you have thousands of dollars of credit card debt, it can feel like you are suffocating t. Because of this, it can be difficult to determine which debt solution is best for you, particularly if you are considering filing for bankruptcy.

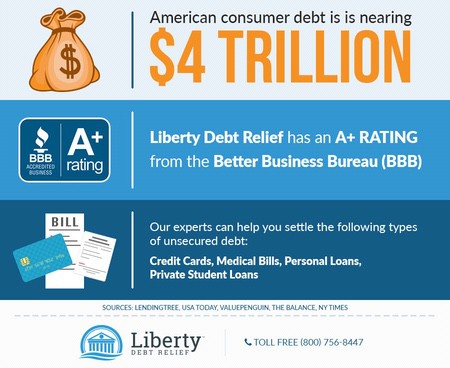

You may be wondering: should I claim bankruptcy or pursue an alternative debt relief option? At Liberty Debt Relief, we know what it’s like to struggle with debt and we pride ourselves on our industry expertise and knowledge. We have analyzed bankruptcy compared to other debt relief options in order to give you a comprehensive overview.

Bankruptcy vs. General Debt Relief

Bankruptcy

Bankruptcy is a legal option that will completely remove all or most of your debt and give you a fresh start financially, but does it comes at a huge cost. This will severely impact your credit score and can stay on your report for several years, which will make it incredibly difficult to open a credit card, get a lease for an apartment, or do anything that involves a credit check. That also includes getting a car, buying a home, or getting a loan.

When deciding between bankruptcy or debt relief, remember that the former might mean you lose any assets you own, this includes your home or any property that you may have. It is also important to mention that all the personal financial information you file with the court, in regards to your bankruptcy, will become become available to the public.

But bankruptcy does provide relief if you do not have any other option. Once you file for bankruptcy your debt collectors and creditors will no longer be able to take action against you for not paying your debt. Dealing with the collection calls and overwhelming debt payments is a big concern for you then this may be a huge relief. It is a huge decision to file for bankruptcy, so it is extremely important to meet with a debt specialist or attorney in order to explore all of your various options before deciding to file.

Debt Relief

There are a variety of debt relief options available today that could be used as an alternative to bankruptcy. At Liberty Debt Relief, we have certified debt specialists who are trained in developing comprehensive plans to help you analyze how you can realistically pay off your debt over time.

When looking into bankruptcy or debt relief, debt settlement is really one of the better options. This is a process that would allow you to pay back a portion of your outstanding debt, while the remainder of the debt is forgiven. This approach does not work for all types of debt and may not be successful for everyone, but working with our experienced specialists can increase your chances.

Debt consolidation is also an option you could explore. It involves combining all of your unsecured debt into one single account so you only have to make one debt payment a month. Meeting with a Liberty Debt Relief expert will help you to explore all of the various debt relief options available to you. You will also be able to come up with a strategic plan to tackle your debt and gain control of your finances.

Impact on your Financial Health

Both bankruptcy and debt relief can have an impact on your overall financial health. It is very important to do your research and meet with the right professionals in order to determine if bankruptcy or debt relief is best for you. With Liberty Debt Relief, you can schedule a free consultation with one of our experts today to review your individual debt circumstances. We work with lenders everyday to negotiate for our clients and have extensive knowledge of the industry. This means we are able give you a comprehensive debt relief solution that have been tested and are successful.

Long Term Financial Success

Our goal is for you gain control of your finances and be set-up to achieve more financial freedom. Filing for bankruptcy or trying to figure out what debt relief option is best can be overwhelming and very stressful, but, with Liberty Debt Relief, you don’t have to face your debt alone. Contact us today to see which of our services is best for you.